coinbase pro taxes uk

Following discussions with the Tax. Choose a Custom Time Range select CSV and click on Generate Report.

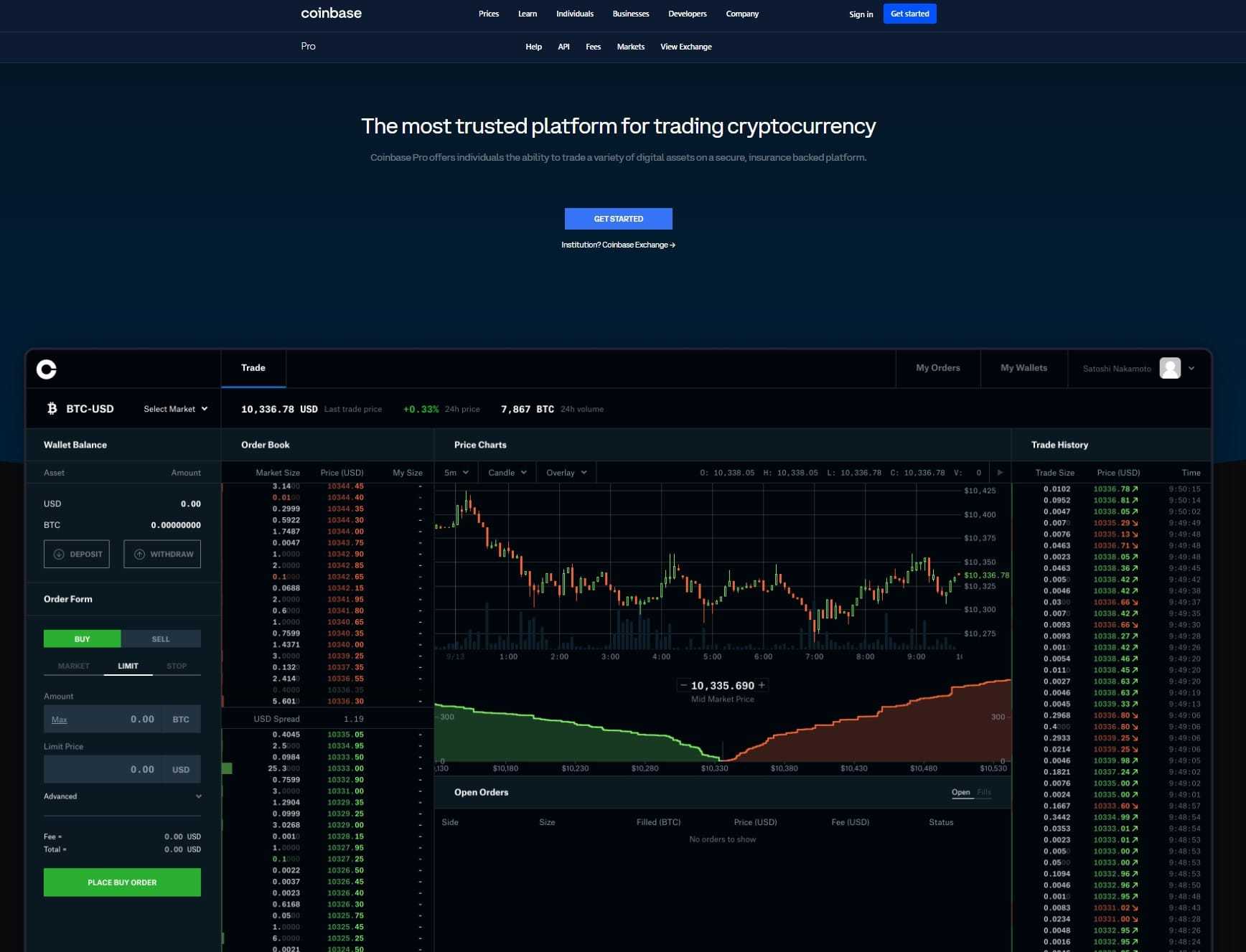

Coinbase Pro Review Is Coinbase Pro Safe Fees Explained

Select Portfolio on the menu at the top of the page.

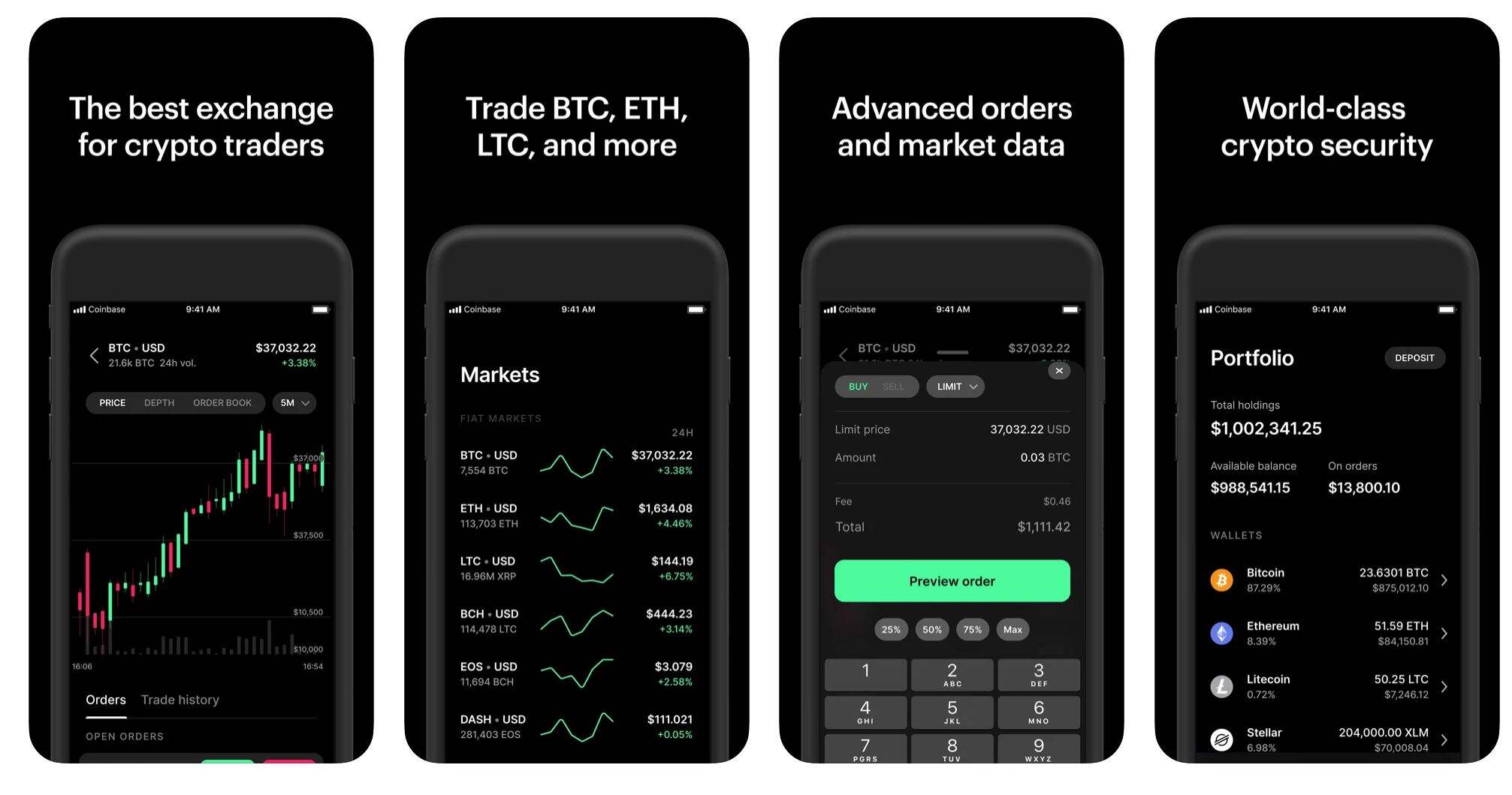

. Support for FIX API and REST API. Heres everything you need to know about Coinbase Pro taxes and reporting including transaction statements profit. Easy safe and secure Join 98 million customers.

Coinbase is the most trusted place for crypto in United Kingdom. Coinbase Tax Resource Center. Select Add cash in the GBP Wallet.

CoinLedger automatically generates your gains losses and income tax reports based on this data. This subreddit is a public forum. Youre also limited to the equivalent of 50000 worth of GBP withdrawals in a day.

Established in 2012 Coinbase is now one of the leading cryptocurrency exchange brokers in the world offering a simplistic platform from which to buy sell spend earn save and use crypto. Import your transaction history directly into CoinLedger by mapping the data into the preferred CSV file format. For individuals in the following states the threshold for receiving a 1099-K is much lower.

Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet. If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. Click on Download ReceiptStatement.

2021-2022 Crypto Tax Glossary. Now available in United Kingdom and in 100 countries around the world. Select Product orders you want to import.

If this is your first time dealing with crypto as part of your tax returns were here to help. But when it comes time to file your Coinbase Pro taxes - it can get a little complicated. Users of the Coinbase exchange to own more than 5000 in cryptocurrency in the UK are going to have the details sent over to the HMRC.

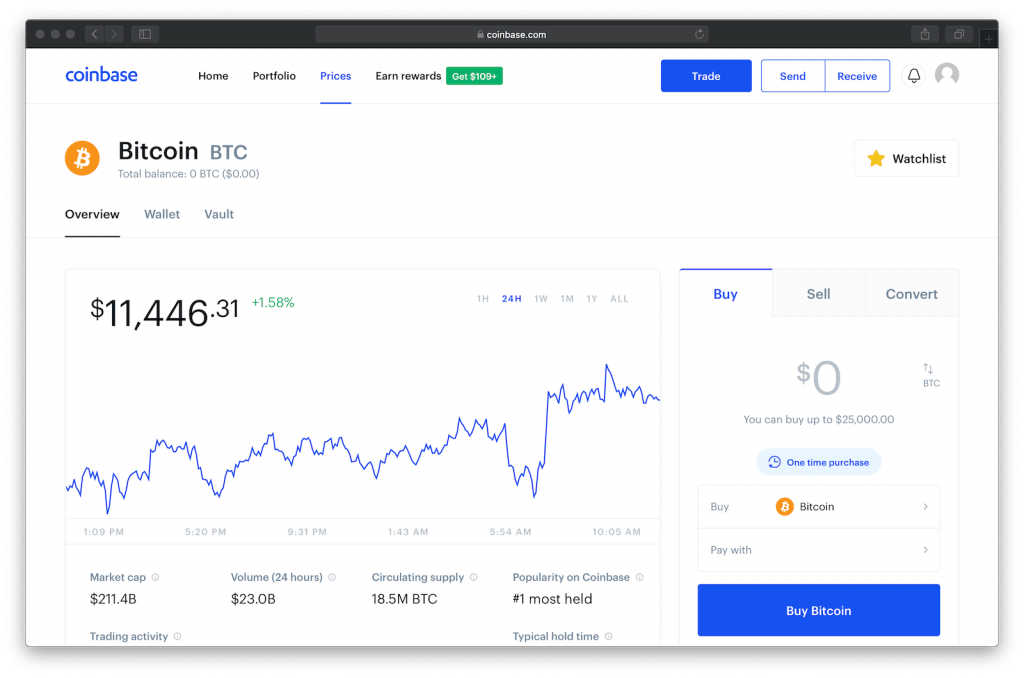

United Kingdom Buy sell and convert cryptocurrency on Coinbase. Read my full Coinbase review UK to discover why this is an excellent choice for traders. Ad Spend Your Time Trading Not Wondering What it Costs.

Your guide to cryptocurrency tax terms in the US. 0 to 050 per trade 249 for Coinbase card. The interesting thing about this is that the HMRC in the UK required the exchange to avoid certain records of its United Kingdom-based customers between 2017 and 2019.

I use TurboTax to do my taxes. Tax Time - Coinbase reports are a joke. You pay taxes on profit which happens at the moment of a sale not on the money you decide to keep here or there.

After youve linked your UK Bank Account follow these steps to initiate adding GBP. To link your UK bank account go to Settings Payment Methods before initiating a transfer. Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP.

If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead of the 1099-Misc. The starting Coinbase Pro withdrawal limit is 50000 per day. Sign up with Coinbase and manage your crypto easily and securely.

Clarifying the 1099K Tax Form From Coinbase Pro For Crypto Investors. For example you can only withdraw 50000 worth of BTC or ETH in a given day. Interestingly this limit applies to an equivalent amount in all currenciesboth fiat and crypto.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. Log in to Coinbase Pro click on My Orders and select Filled. Use the information displayed to initiate a UK bank transfer in GBP from your UK.

Once you receive your files via email save them and upload them here. Coinbase does not provide a Form 1099-B like a traditional broker and as of the tax year 2020 will not be providing a Form 1099-KIt does provide a Form 1099-MISC on the conditions that you are a Coinbase customer a US tax-person and earned at least 600 from Coinbase Earn USDC Rewards andor Staking this year. Once you sell its called realized gainloss.

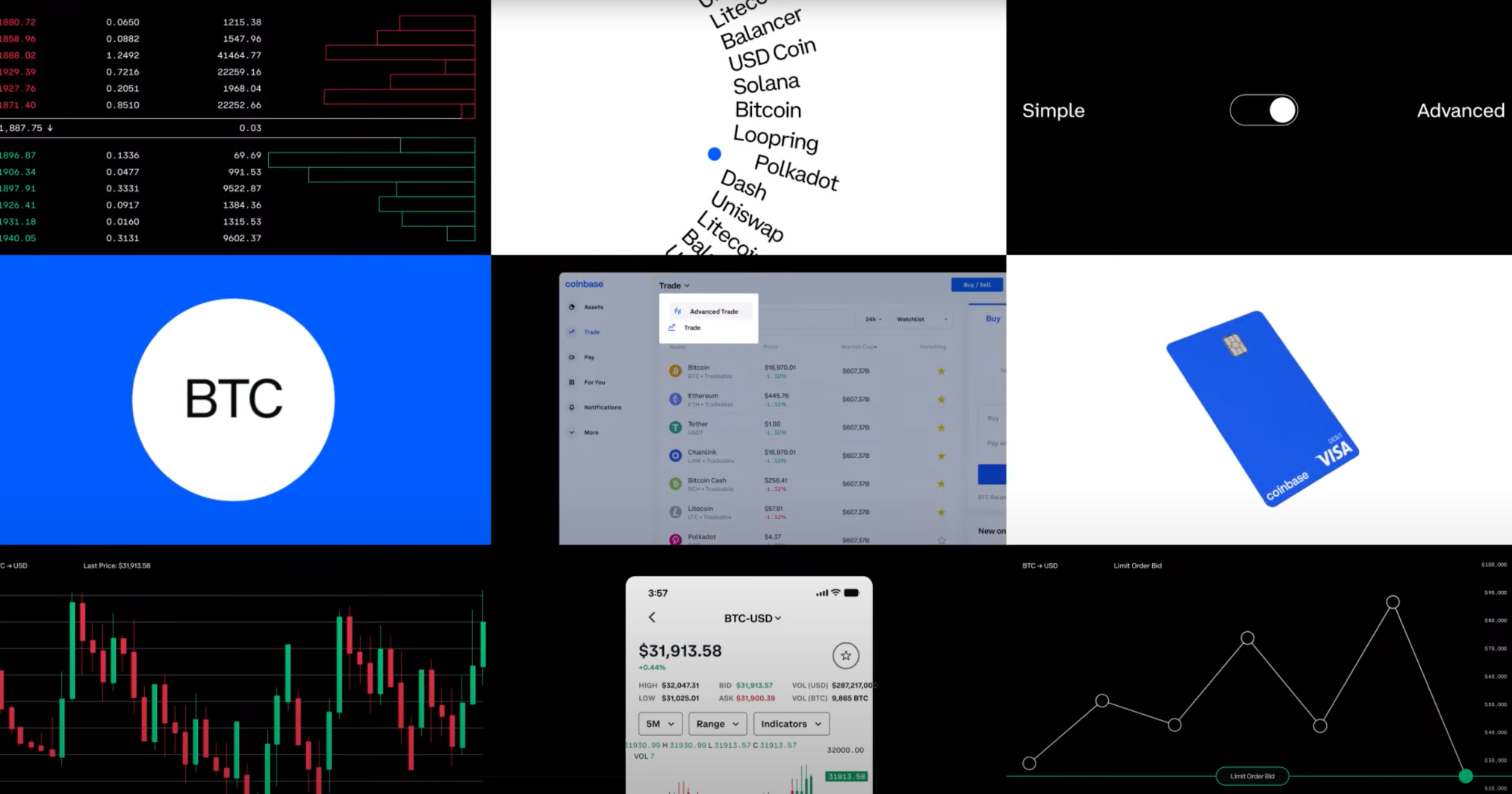

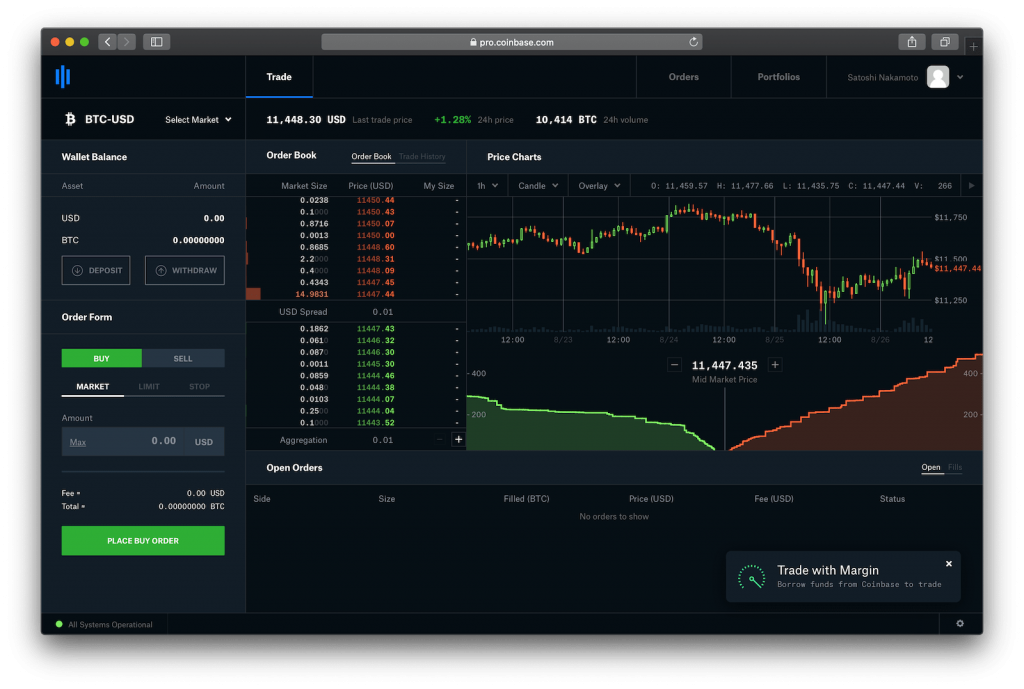

What About Coinbase Pro Tax Documents. Coinbase Pro features advanced charting features and a huge range of crypto trading pairs - making it an ideal exchange for more experienced crypto traders. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history.

According to my GainLoss Report from Coinbase I have a 3300 loss from crypto on Coinbase last year. First - I decided to go into Coinbase and download the CSV designated as being for TurboTax use. Coinbase Review UK.

Coinbase To Launch Advanced Trade As A Replacement For Coinbase Pro

:max_bytes(150000):strip_icc()/Uphold-vs-Coinbase-01-852cc0c408fa48399d4f3dd648f202c4.jpg)

Uphold Vs Coinbase Which Should You Choose

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

Why You Should Buy Bitcoin On Coinbase Pro And Not Coinbase Cove Markets

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Coinbase Pro Shut Down To Be Replaced By New Coinbase App

Coinbase Review August 2022 Is Coinbase A Scam Find Out Now

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Pro Review 2022 A Reputable And Safe Crypto Exchange

The Ultimate Coinbase Pro Taxes Guide Koinly

Margin Trading Is Now Available On Coinbase Pro By Coinbase The Coinbase Blog

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog